Business Insurance in and around Abilene

One of the top small business insurance companies in Abilene, and beyond.

Helping insure businesses can be the neighborly thing to do

This Coverage Is Worth It.

Running a small business comes with a unique set of highs and lows. You shouldn't have to work through those alone. Aside from just your loved ones, let State Farm be part of your line of support through insurance options including a surety or fidelity bond, worker's compensation for your employees and business continuity plans, among others.

One of the top small business insurance companies in Abilene, and beyond.

Helping insure businesses can be the neighborly thing to do

Small Business Insurance You Can Count On

At State Farm, apply for the outstanding coverage you may need for your business, whether it's a pizza parlor, a yogurt shop or a gift shop. Agent Risha Sanders is also a business owner and understands your needs. Not only that, but personalized insurance options is another asset that sets State Farm apart. From one small business owner to another, see if this coverage can't be beat.

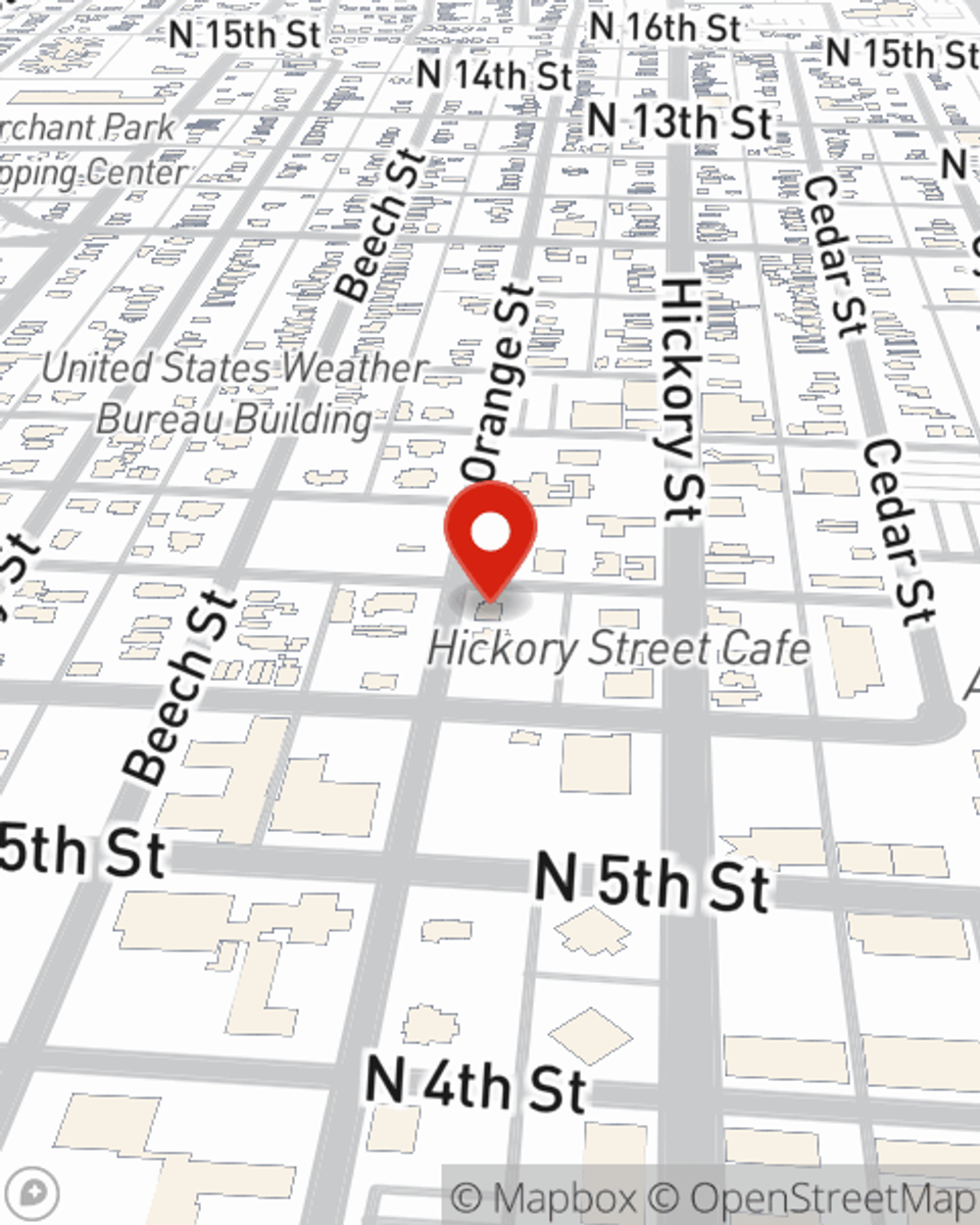

Ready to talk through the business insurance options that may be right for you? Visit agent Risha Sanders's office to get started!

Simple Insights®

Fire safety for businesses

Fire safety for businesses

Learn workplace fire safety and prevention tips to help protect your employees and business.

How to grow your small business

How to grow your small business

Growing a small business takes strategic planning and research. Consider these helpful tips on ways to grow a small business to help ensure future success.

Risha Sanders

State Farm® Insurance AgentSimple Insights®

Fire safety for businesses

Fire safety for businesses

Learn workplace fire safety and prevention tips to help protect your employees and business.

How to grow your small business

How to grow your small business

Growing a small business takes strategic planning and research. Consider these helpful tips on ways to grow a small business to help ensure future success.